|

|

Is Mettler-Toledo International Stock Underperforming the Dow?/Mettler-Toledo%20International%2C%20Inc_%20logo%20and%20phone%20-by%20IgorGolovniov%20via%20Shutterstock.jpg)

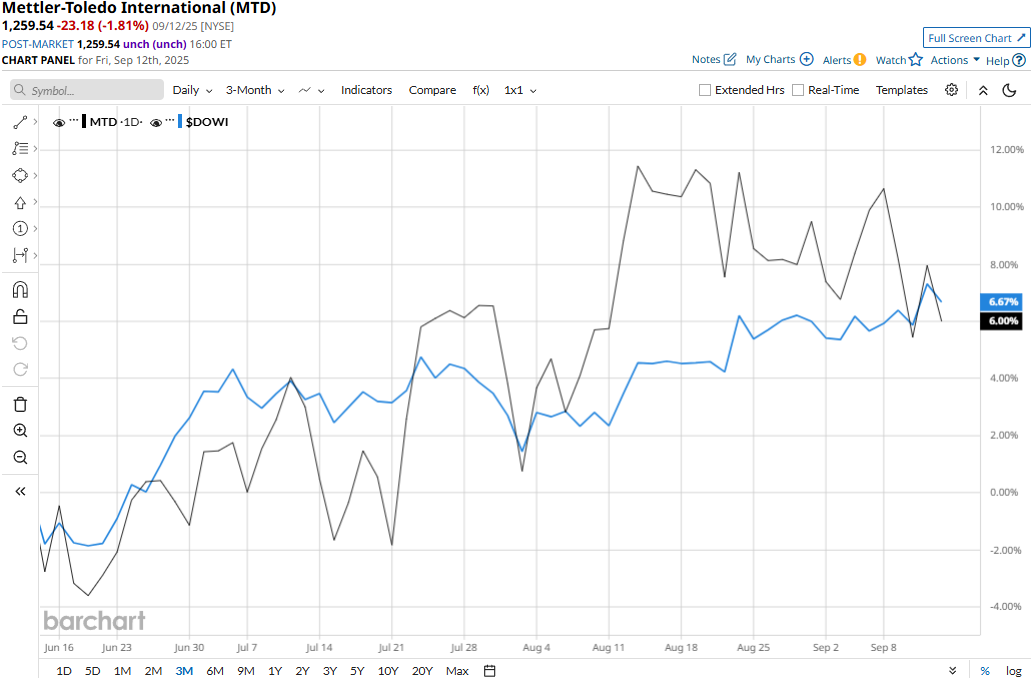

Columbus, Ohio-based Mettler-Toledo International Inc. (MTD) is the world's largest marketer of weighing instruments for use in laboratory, industrial, and food retailing applications. With a market cap of $25.9 billion, Mettler’s operations span the Americas, Europe, Asia, and internationally. Companies worth $10 billion or more are generally described as "large-cap stocks." MTD fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the laboratory instruments industry. Despite its notable strengths, MTD stock has declined 17.2% from its 52-week high of $1,521.01 touched on Oct. 2, 2024. Meanwhile, MTD stock has gained 6% over the past three months, slightly lagging behind the Dow Jones Industrial Average’s ($DOWI) 6.7% uptick during the same time frame.

Over the longer term, MTD’s performance has remained much grimmer. MTD stock has gained 2.9% on a YTD basis and plunged 8.3% over the past 52 weeks, underperforming Dow’s 7.7% returns in 2025 and 11.5% surge over the past year. MTD stock has remained mostly below its 200-day moving average over the past year until recently and traded above its 50-day moving average since May, underscoring its overall bearish trend and recent upturn.

Despite reporting better-than-expected results, Mettler-Toledo International’s stock prices declined nearly 3% in the trading session following the release of its Q2 results on Jul. 31. In spite of challenging market conditions, the company delivered growth across most of its businesses. Its net sales for the quarter increased by a notable 3.9% year-over-year to $983.2 million, surpassing the Street expectations by 2.7%. Meanwhile, its adjusted EPS increased 4.6% year-over-year to $10.09, exceeding the consensus estimates by 5.3%. Following the initial dip, MTD stock prices gained 2.9% in the subsequent trading session. Mettler-Toledo has notably outperformed its peer, IQVIA Holdings Inc.’s (IQV) 4.7% dip in 2025 and 21.5% decline over the past 52 weeks. Among the 13 analysts covering the MTD stock, the consensus rating is a “Moderate Buy.” Its mean price target of $1,330.45 suggests a modest 5.6% upside potential from current price levels. On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|